CREDIT SEARCH FOR EMPLOYMENT

Does your prospective employee screening include a credit check for employment? If the answer is no, you should be aware that you may be entitled to – or even required to – under state and federal law. This single step can empower you to prevent costly losses while simultaneously fulfilling regulatory requirements in high-security industries.

Employers lose more money than ever to in-house theft and white collar crimes, thefts, and inventory loss. IMI Data Search’s Credit Check for Employment stems the tide by ensuring you know exactly who you are hiring before you hire.

Unfortunately, navigating state and federal laws surrounding credit checks can be daunting. Complex regulatory systems like the FCRA and ICRAA define exactly when, how, where, why, and what employers can screen. If complex regulatory guidelines are holding you back from taking advantage of an employment credit check, we want to invite you to explore our services. Our innovative platform and reporting process streamlines reports from request to delivery, mitigating risks so you can reap the benefits without risking losses.

Employers lose more money than ever to in-house theft and white collar crimes, thefts, and inventory loss. IMI Data Search’s Credit Check for Employment stems the tide by ensuring you know exactly who you are hiring before you hire.

Unfortunately, navigating state and federal laws surrounding credit checks can be daunting. Complex regulatory systems like the FCRA and ICRAA define exactly when, how, where, why, and what employers can screen. If complex regulatory guidelines are holding you back from taking advantage of an employment credit check, we want to invite you to explore our services. Our innovative platform and reporting process streamlines reports from request to delivery, mitigating risks so you can reap the benefits without risking losses.

What is a Credit Search for Employment?

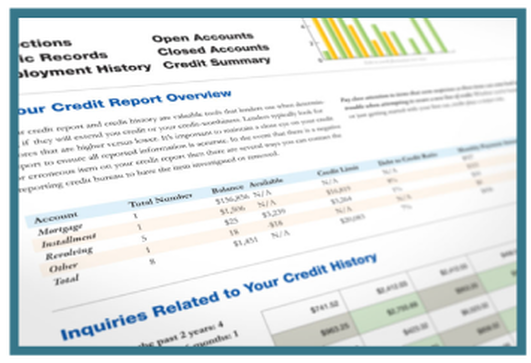

A Credit Check for Employment contains information about a prospective candidate’s credit history. IMI Data Search sources this report from one of three of America’s top credit bureaus, including Equifax, TransUnion, and Experian.

At IMI Data Search, we recognize that credit records may differ from bureau to bureau. That’s why our reports often source information from all three to provide you with the most balanced and accurate result.

According to the Fair Credit Reporting Act (FCRA), all employers must first seek written consent to screen before running any background check, including any credit checks. Consent forms must include a disclaimer identifying how and why the employer will use the information as well as a copy of the FCRA itself.

A Credit Check for Employment is not the same as commercial or retail credit reports; they contain far less information and fewer details. However, these reports are still rich with a long list of useful information:

At IMI Data Search, we recognize that credit records may differ from bureau to bureau. That’s why our reports often source information from all three to provide you with the most balanced and accurate result.

According to the Fair Credit Reporting Act (FCRA), all employers must first seek written consent to screen before running any background check, including any credit checks. Consent forms must include a disclaimer identifying how and why the employer will use the information as well as a copy of the FCRA itself.

A Credit Check for Employment is not the same as commercial or retail credit reports; they contain far less information and fewer details. However, these reports are still rich with a long list of useful information:

In some cases, an employment credit check may also contain a record of financial crimes (e.g., bank fraud or cashing bad checks). These histories are an instant red flag that the candidate you are considering may be unreliable, untrustworthy, or even a con artist.

Why You Need Credit Checks for Employment

A bad credit report could be a sign that someone has gone through an exceptionally tough time – divorce, illness, or job loss. But it can also identify candidates who are either untrustworthy, unstable, or unreliable. Screening credit is a quick and easy way to see how prospective candidates handle serious responsibilities. This may empower you to predict how they handle serious responsibilities at work.

A Credit Check for Employment also contains a record of past addresses and SSNs, giving employers the power to verify whether or not someone is legally permitted to work in the United States in the first place. This alone is a significant benefit. A mismatched SSN, past address, current address, or identity information may be a red flag for fraud, including stolen identities and illegal immigration status, making it much harder for a savvy candidate to defraud you.

Depending on the industry you operate in, you may also be required to screen credit history by law. The Society of Human Resources Management (SHRM) reports that up to 60 percent of all employers now use credit checks before they hire. Most (but not all) of these employers fall within these highly regulated industries:

A Credit Check for Employment also contains a record of past addresses and SSNs, giving employers the power to verify whether or not someone is legally permitted to work in the United States in the first place. This alone is a significant benefit. A mismatched SSN, past address, current address, or identity information may be a red flag for fraud, including stolen identities and illegal immigration status, making it much harder for a savvy candidate to defraud you.

Depending on the industry you operate in, you may also be required to screen credit history by law. The Society of Human Resources Management (SHRM) reports that up to 60 percent of all employers now use credit checks before they hire. Most (but not all) of these employers fall within these highly regulated industries:

The government recognizes that the risk of hiring someone who is financially irresponsible or criminally irresponsible with money in these industries is extremely high. Following through with screening ensures you put your trust in the right person.

Some states allow all employers to screen credit histories before they hire, regardless of the position, industry, or job title. Whether you screen by choice or to fulfill legal requirements, the information contained within your report is still an invaluable asset. Use it to prevent costly losses and liability issues before they happen.

Some states allow all employers to screen credit histories before they hire, regardless of the position, industry, or job title. Whether you screen by choice or to fulfill legal requirements, the information contained within your report is still an invaluable asset. Use it to prevent costly losses and liability issues before they happen.

How IMI Data Search Helps With Credit Checks for Employment

IMI Data Search makes it easy and reliable to access a fast, accurate Credit Check for Employment from anywhere. Rather than screening in-house, you simply place your order and include consent forms – we do the rest of the work for you.

The FCRA, ICRAA, and other state laws make it extremely difficult for employers to self-navigate compliance issues around employment Credit Checks. Laws often differ dramatically state-to-state, and in some cases, city-to-city. If you screen in-house, you are risking serious compliance and legal issues when something goes wrong. From consent to disputes, even a slight error can cost employers thousands of dollars in negligent hiring lawsuits.

Considering hiring an in-house expert? Hiring a subject matter expert or lawyer to guide your screening process just isn’t cost or time-efficient. ROI is almost always poor, especially for SMBs. It just doesn’t make sense to hire your own expert when you can screen safely and efficiently right from your office – right now!

BENEFITS OF OUR PLATFORM

At IMI Data Search, we reduce pressure on businesses by handling most of the credit check process behind the scenes. Our highly-secure platform exceeds industry standards for both security and accidental noncompliance protection. This keeps both you and your prospective candidate safe from identity theft or harm. Our subject matter experts are always just a telephone call away. If you have a question, you can get answers fast without paying expensive lawyer’s consultation fees.

Already using business management or recruiting software? The IMI Data Search system flawlessly integrates with KeneXa, PeopleSoft, HRSmart, peoplefluent, MyStaffingPro, Oracle, iCims, Nawbo, TechnoMedia, and KRONOS.

We’ve worked hard to establish a strong alliance and partnerships with these diverse companies and organizations to create a strong network for success. Our mission is to make screening an affordable, reliable, and trustworthy option for every business in the United States. We want to personally invite you to partner with us. See for yourself just how easy it is to access rapid recruiting intelligence that keeps your business safe.

The FCRA, ICRAA, and other state laws make it extremely difficult for employers to self-navigate compliance issues around employment Credit Checks. Laws often differ dramatically state-to-state, and in some cases, city-to-city. If you screen in-house, you are risking serious compliance and legal issues when something goes wrong. From consent to disputes, even a slight error can cost employers thousands of dollars in negligent hiring lawsuits.

Considering hiring an in-house expert? Hiring a subject matter expert or lawyer to guide your screening process just isn’t cost or time-efficient. ROI is almost always poor, especially for SMBs. It just doesn’t make sense to hire your own expert when you can screen safely and efficiently right from your office – right now!

BENEFITS OF OUR PLATFORM

At IMI Data Search, we reduce pressure on businesses by handling most of the credit check process behind the scenes. Our highly-secure platform exceeds industry standards for both security and accidental noncompliance protection. This keeps both you and your prospective candidate safe from identity theft or harm. Our subject matter experts are always just a telephone call away. If you have a question, you can get answers fast without paying expensive lawyer’s consultation fees.

Already using business management or recruiting software? The IMI Data Search system flawlessly integrates with KeneXa, PeopleSoft, HRSmart, peoplefluent, MyStaffingPro, Oracle, iCims, Nawbo, TechnoMedia, and KRONOS.

We’ve worked hard to establish a strong alliance and partnerships with these diverse companies and organizations to create a strong network for success. Our mission is to make screening an affordable, reliable, and trustworthy option for every business in the United States. We want to personally invite you to partner with us. See for yourself just how easy it is to access rapid recruiting intelligence that keeps your business safe.